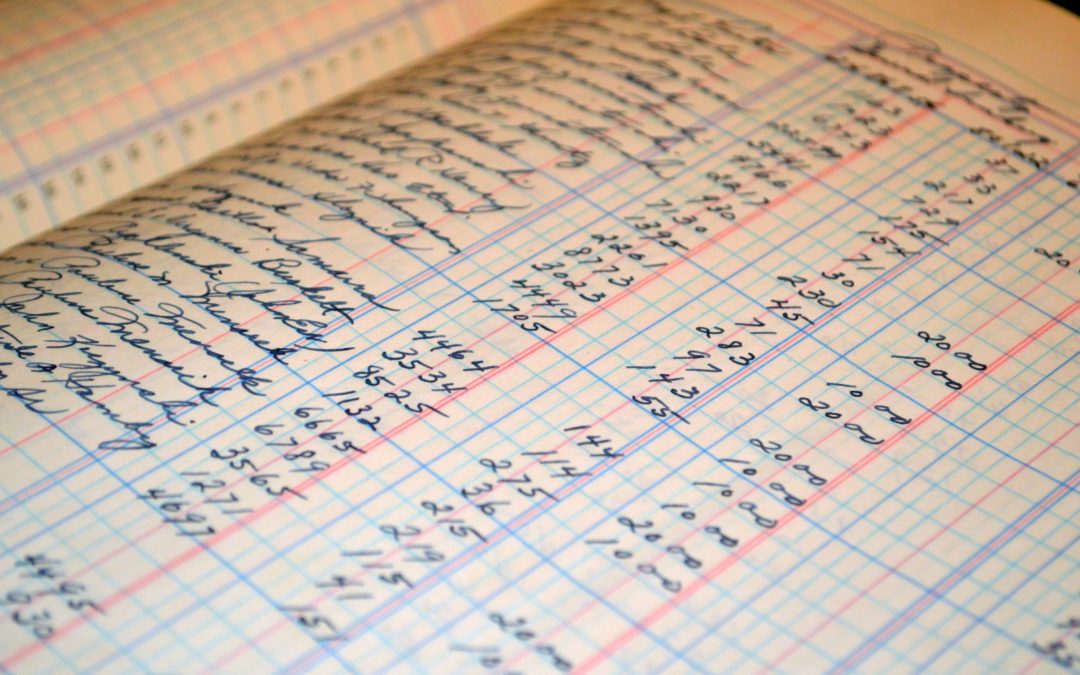

What is it?

A general ledger is a master financial document that accounts for all of a company’s debit and credit transactions in opposing sections. The reason for a general ledger is to get a full grasp of a company’s financial wellness. A general ledger can be used to create a balance sheet and profit/loss assessment. General ledgers are also great to have on hand in case there is a discrepancy in company finances.

Why is it important?

While you are free to decide what is right for your own business, there are several reasons why you should consider implementing a general ledger for your business. First and foremost, you need to ensure that your business is compliant with tax laws. Not having the appropriate documents prepared can leave you in serious trouble if you were to be audited. A general ledger is necessary to accurately account for numerous expenses and assets.

For some smaller businesses, the amount of time spent costs more than it may be worth, while larger businesses may find them vital. Whether you need one depends on the specifics of your own company. Here are just a few reasons why you should consider creating one.

- Balancing your books

- It helps you compile a trial balance, so that you can ascertain whether your business is profiting or losing money over time.

- Makes filing tax returns easier

- The general ledger helps you compile all of your income and expenses in one place which makes it easier and faster when it comes time to do your taxes.

- Staying on top of spending

- Having all of your business’ transactions in one place can paint a clearer picture of your spending habits. You will be able to see real revenue and expenses which helps you figure out where you should trim your expenses.

- Helps identify and prevent fraud

- Documenting every financial transaction gives you complete clarity over financial activity within all of your accounts. If you suspect any unusual activity, you will be able to spot it quickly and stop fraudulent spending from causing heavy financial losses. What information does a general ledger tell you?

Need help managing your finances?

We understand how difficult it can be for you to balance all of your company’s needs and still make time to take care of your finances. There may not be enough time in the day to handle everything on your plate. Save yourself some stress and take one item off your to-do list by hiring an experienced accountant with over years of experience. Then, you will be able to focus on the other aspects of your business. The experts at Riedel-Hogan CPA can help you decide what is best for you, whether you own a small business, a start-up, or a non-profit. We’d love to talk with you about your options. Schedule an appointment today!